Bankrate payroll deductions calculator

How do the number of allowances affect the federal tax withholdings. These taxes are for FICA taxes Social Security and Medicare taxes.

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

9 Best Tax Deductions For Freelancers To Claim.

. Updated the tax tables. Heres the IRS rule of thumb. After You Use the Estimator.

How much will my take-home pay change if I contribute more to my 401k. Using deductions is an excellent way to reduce your Oklahoma income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and Oklahoma tax returns. By Taylor Medine Contributor What Are Payroll Taxes.

Including USA Today CBS News Yahoo Finance MSN Money Bankrate Kiplinger. In a larger sense investing can also be about. Investing is the process of buying assets that increase in value over time and provide returns in the form of income payments or capital gains.

Using deductions is an excellent way to reduce your Alabama income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and Alabama tax returns. 41 - Alabama Standard Deduction. Because this number reflects taxable earnings before deductions were made it could be more than the amount in box 1.

Use your estimate to change your tax withholding amount on Form W-4. Updated tax tables for 2022. Bankrate LLC NMLS ID 1427381 NMLS Consumer Access.

Not to be confused with the federal income tax FICA taxes fund the Social Security and Medicare programs. For details on specific deductions available in Alabama see the list of Alabama income tax deductions. Bankrate February 2022 HR Blocks free version is better than most because it can also handle unemployment income bank interest and dividends income student loan interest and schedules 1 and 3 for a total of.

For a final figure take your gross income before adjustments. 9 Best Tax Deductions For Freelancers To Claim. 41 - Oklahoma Standard Deduction.

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security benefits and. Cost of living comparison calculator. Be informed and get ahead with.

Using deductions is an excellent way to reduce your Michigan income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and Michigan tax returns. Make your retirement plan solid with tips advice and tools on individual retirement accounts 401k plans and more. Estimate your Net Take Home Pay using this Paycheck Calculator for Excel.

Also known as payroll taxes FICA taxes are automatically deducted from your paycheckYour company sends the money along with its. Or keep the same amount. Thats because Social Security cant tax employees above a certain threshold which is 142800 for the 2021 tax year.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. 41 - Michigan Standard Deduction. Choose the appropriate calculator below to compare saving in a 401k account vs.

If you earn 60000 per year and get paid every two weeks youll be paid 24 times during the yearIf you divide 60000 by 24 youll get 2500 in gross pay each pay periodIf you quit after working 12 pay periods your earnings to date on the day you quit will be 2500 X 12 30000 You can use this same formula to calculate your net earnings take-home pay to date. Bankrate is compensated. For details on specific deductions available in Oklahoma see the list of Oklahoma income tax deductions.

Including USA Today CBS News Yahoo Finance MSN Money Bankrate. IRA to Roth conversion. The number in box 3 could also be lower than whatever appears in box 1.

The IRS released the new standard deductions for 2022 which have increased from the amounts available on 2021 tax returns. Charitable deductions and divide your tax bill by that number. You can use above-the-line deductions such as the student loan interest deduction to reduce your incomeeven if you dont itemize deductions on your tax return.

CD Calculator Compound Interest Calculator Savings Calculator. Payroll Payroll services and support to keep you compliant. First enter your current payroll information and deductions.

If you earn a wage or a salary youre likely subject to Federal Insurance Contributions Act taxes. Answer questions such as. Use this calculator to help you determine your paycheck for hourly wages.

An Employees Guide. For details on specific deductions available in Michigan see the list of Michigan income tax deductions. To change your tax withholding amount.

In addition to income taxes the largest tax bill that small businesses pay is payroll taxes. Your portion as an employer is 765 of the employee gross payroll. If you have filed a return every year reported all your income and done nothing fraudulent keep tax records for three years.

Add back in your allowable above the line deductions for example retirement and health savings account contributions. Then enter the hours you expect to work and how much you.

Payroll Time Conversion Chart Payroll Calculator Decimal Time

Easy Cap Rate Calculator Rentspree Blog

Pin On Payroll

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Taxation Services In Hyderabad Tax Debt The Motley Fool Tax Free Investments

Pin On 044 Investing Fintech

Paycheck Calculator Salaried Employees Primepay

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

What Is Net Income Definition How To Calculate It Bankrate

How To Calculate Interest Rate 10 Steps With Pictures Wikihow

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Hire Freelance Independent Consultants Talmix Mba Co Mba Independent Consultant Hiring

Super Bowl 51 Predictions In A Game Of Inches Super Bowl 51 Super Bowl Live Superbowl 2017

The 4 Best Cost Of Living Calculators Ciresi Morek

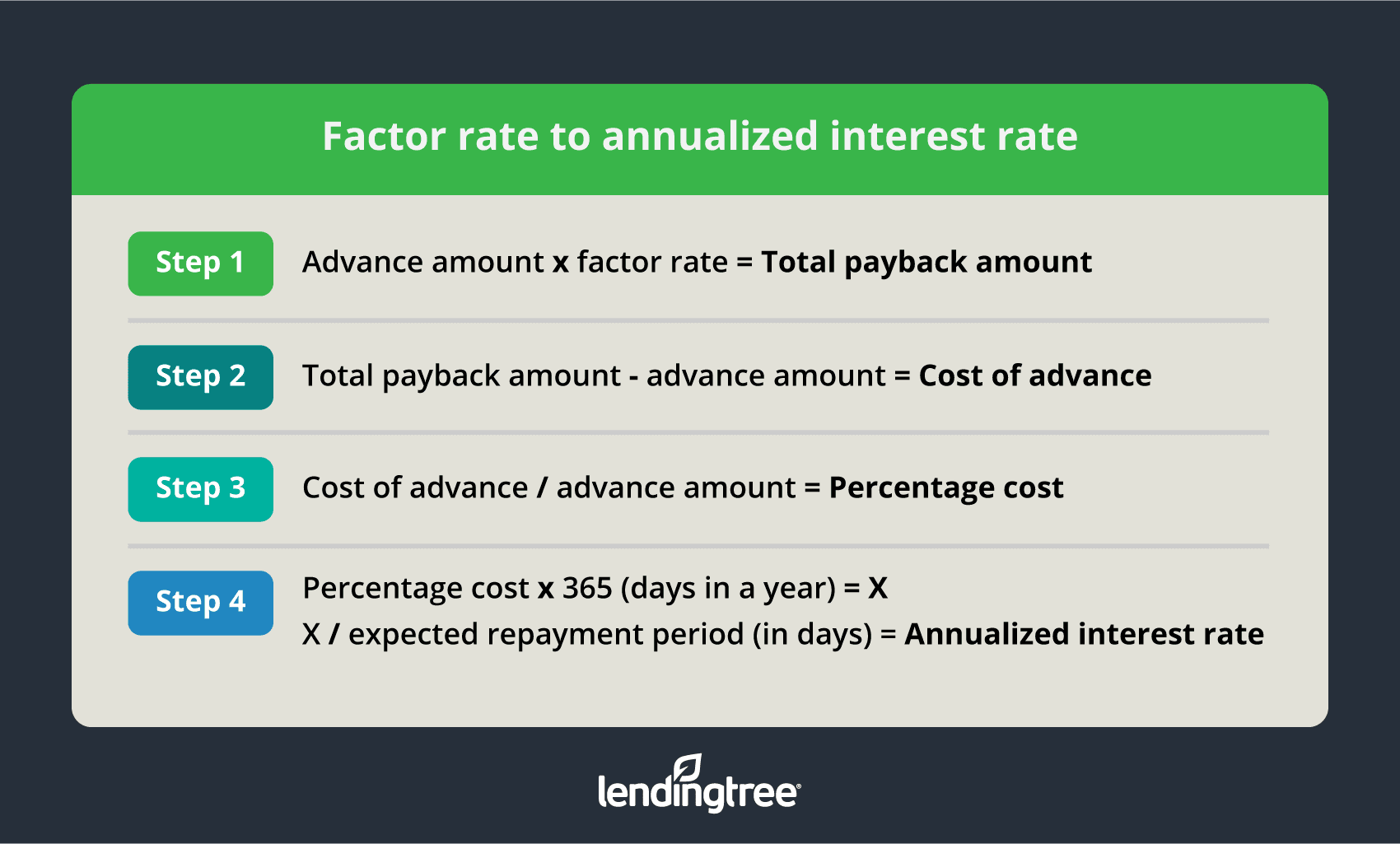

What Is A Factor Rate And How Do You Calculate It

9 Ways For High Earners To Reduce Taxable Income 2022

9 Ways For High Earners To Reduce Taxable Income 2022